richmond property tax rate

209 of total minimum fee of 250. The Richmond County Board of Assessors regular meetings are held on the second Monday of each month at 4 pm.

Virginia Property Tax Calculator Smartasset

Vagas Jackson Tax Administrator 1401 Fayetteville Rd.

. Learn all about Richmond Heights real estate tax. Property Taxes Calculating Your Richmond Hill Property Tax Due. 4 rows Residential Property Tax Rate for Richmond from 2018 to 2021.

14 and June 14. Real Estate and Personal Property Taxes Online Payment. Vehicle License Tax Antique.

Notice to Property Owners and Occupants Pursuant to state statute OCGA. For all who owned property on January 1 even if the property has been sold a tax bill will still be sent. Due Dates and Penalties for Property Tax.

Year Municipal Rate. Look up Property Cards. Personal Property Taxes are billed once a year with a December 5 th due date.

Whether you are already a resident or just considering moving to Richmond Heights to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Province of BCs Tax Deferment Program. Parking Violations Online Payment.

Town of Richmond 105 Old Homestead Highway Richmond NH 03470 603-239-4232. The current millage rate is 4132. Website Design by Granicus - Connecting People and Government.

What are the property taxes in Richmond NH. June 5 and Dec. What is considered real property.

Parking tickets can now be paid online. June 5 and Dec. Vehicle License Tax Vehicles.

Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. Richmonds real estate tax rate is 120 per 100 of assessed value. Payments can be mailed to.

Real estate taxes are due on January 14th and June 14th each year. If you are considering taking up residence there or just planning to invest in the citys property youll come to understand whether the citys property tax laws are well suited for you or. Without Senior Discount Applied.

June 1 and Dec. Understanding Your Tax Bill. 48-5-2641 notice is provided that staff of the appraisal office conducts field checks to update property characteristics.

What is the real estate tax rate for 2021. In Person at the counter Property Tax Payment Fees. Taxpayer Property Account Information.

The Town of Richmonds property tax due dates are as follows. You will get limited information. Property tax bills are mailed in July of each year.

Including data such as Valuation Municipal County Rate State and Local Education tax dollar amounts. Register to Receive Certified Tax Statements by email. Call 804 646-7000 or send an email to the Department of Finance.

City millage rate based on the house value of 250000 for select years. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Car Tax Credit -PPTR.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. CREDITDEBIT CARD CONVENIENCE FEES APPLY.

The real estate tax rate is 120 per 100 of the properties assessed value. Paying Your Property Taxes. What is the due date of real estate taxes in the City of Richmond.

Inquiresearch property tax information. 8152021 11152021 2152022 and 5162022. New to Richmond County.

Property Tax Payments can be made at all locations by cash check and most major credit cards. These documents are provided in Adobe Acrobat PDF format for printing. Vehicle License Tax Motorcycles.

Examples are shown below with and without seniors discount. City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456. Manage Your Tax Account.

Property Taxes Due 2021 property tax bills were due as of November 15 2021. Sign in as ANONYMOUS. With this guide you can learn valuable facts about Richmond property taxes and get a better understanding of things to expect when it is time to pay.

The new assessments will be used to calculate tax bills mailed to city property owners next year. Town Center Building 203 Bridge St PO Box 285. Click Here to Pay Parking Ticket Online.

Pay Your Parking Violation. Tax Sales Next Tax Sale is scheduled for Tuesday September 1st 2022. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

City of Richmond adopted a tax rate. Rockingham NC 28379 Business. Call Selectmens office 239-4232 for a complete tax card.

Personal Property Registration Form An. View more information about payment responsibility.

Millage Rates Richmond County Tax Commissioners Ga

Residential Property Tax Calculator

What Is The Property Tax Rate In Richmond Tx Cubetoronto Com

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Toronto Property Taxes Explained Canadian Real Estate Wealth

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Virginia Property Tax Calculator Smartasset

About Your Tax Bill City Of Richmond Hill

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Toronto Property Taxes Explained Canadian Real Estate Wealth

About Your Tax Bill City Of Richmond Hill

Ontario Property Tax Rates Lowest And Highest Cities

City Of Richmond Adopts 2022 Budget And Tax Rate

Richmond Hill Property Tax 2021 Calculator Rates Wowa Ca

Toronto Property Taxes Explained Canadian Real Estate Wealth

Where Can I Find My Account Number And Access Code Myrichmond Help

About Your Tax Bill City Of Richmond Hill

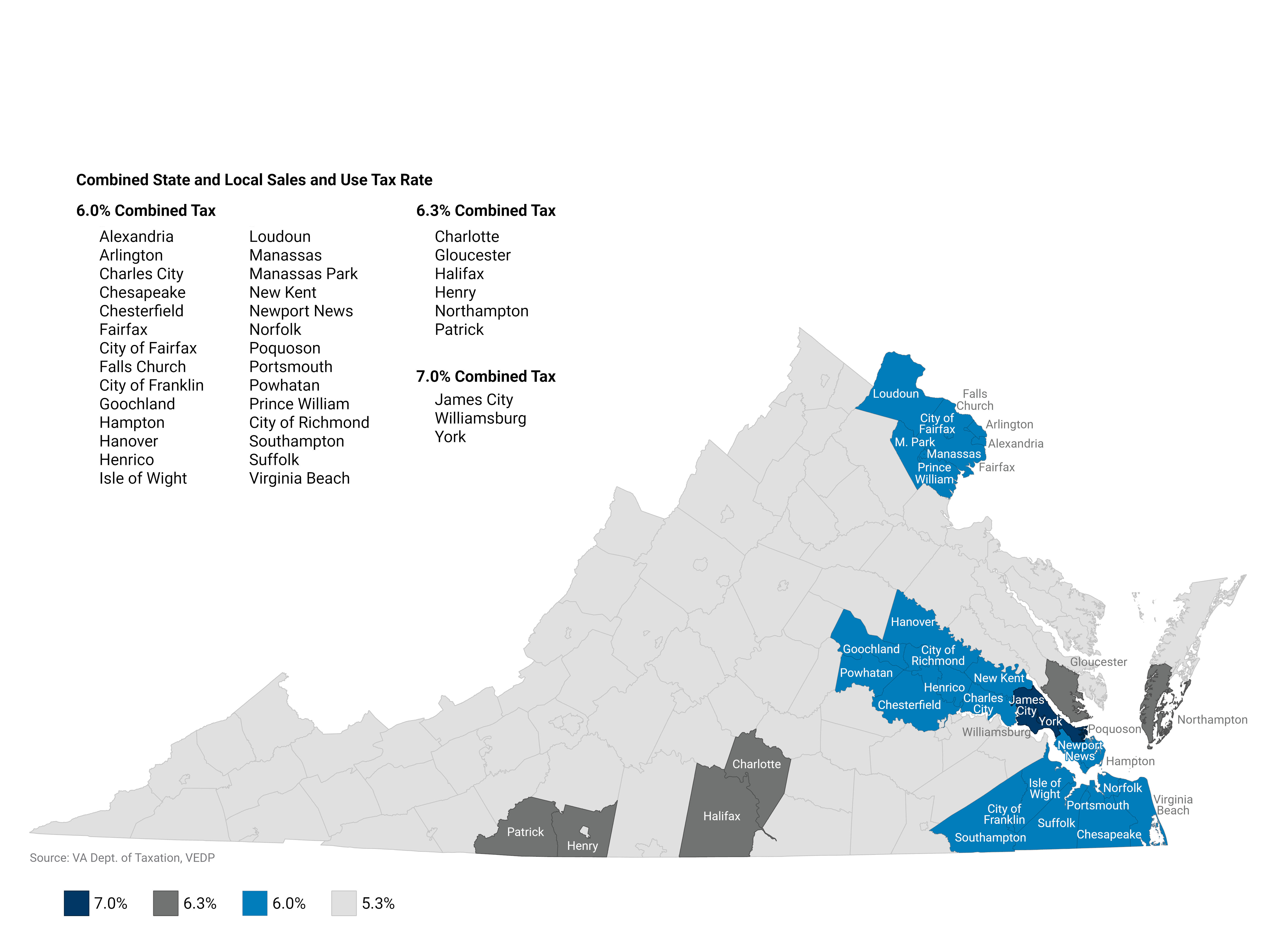

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership